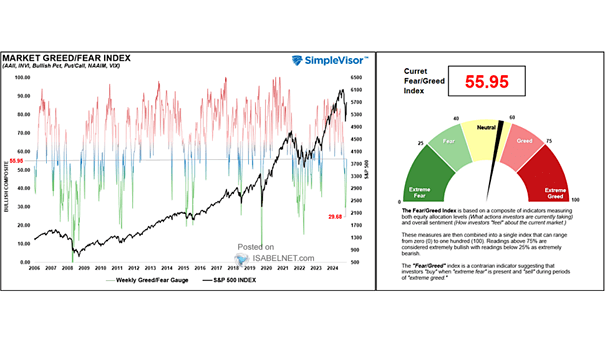

Investor Sentiment – U.S. Market Greed/Fear Index

Investor Sentiment – U.S. Market Greed/Fear Index With a current value of 68.15, the Market Greed/Fear Index still indicates a prevailing sentiment of greed among investors, revealing their appetite for higher risk-taking in the U.S.…