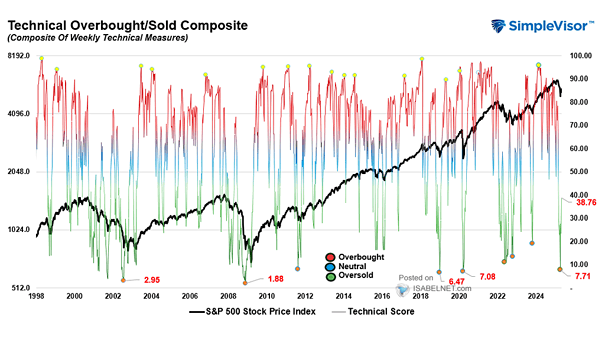

S&P 500 Index and Technical Score

S&P 500 Index and Technical Score With a reading of 55.41, the U.S. stock market is no more overbought, suggesting a potential shift in investor sentiment and a possible opportunity for market participants to reassess…