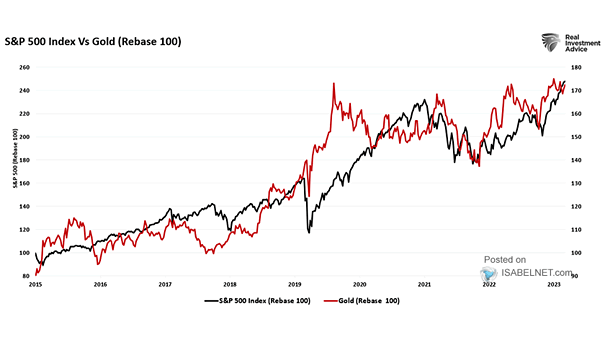

Gold Price vs. S&P 500 Index and Recessions

Gold Price vs. S&P 500 Index and Recessions Throughout history, gold has been considered a safe haven during market declines. Since 2015, its correlation with U.S. stocks has strengthened, making it more likely for gold…