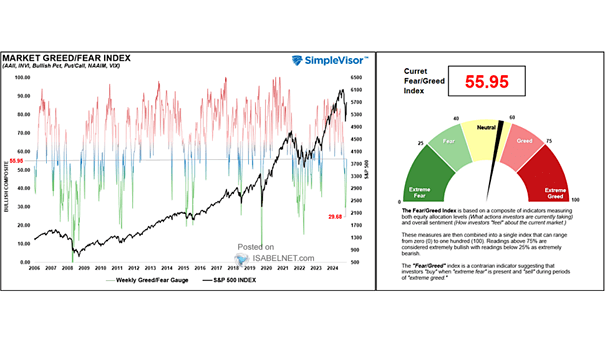

Investor Sentiment – U.S. Market Greed/Fear Index

Investor Sentiment – U.S. Market Greed/Fear Index With a current value of 72.55, the Market Greed/Fear Index indicates optimistic investor sentiment in the U.S. stock market, reflecting a greedy market. Image: Real Investment Advice