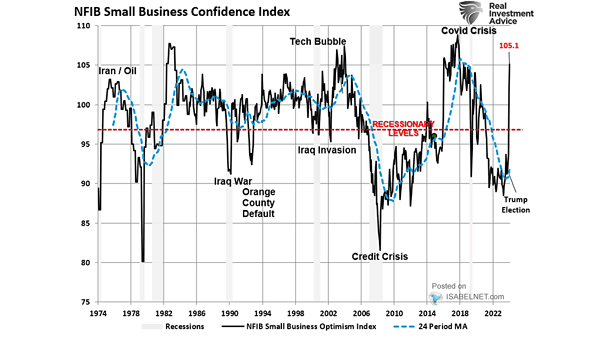

NFIB Small Business Confidence Index

NFIB Small Business Confidence Index The NFIB Small Business Confidence Index has fallen to 88.5, a level linked with recessions. This decline is concerning as it suggests small business owners are less optimistic about their…