For Professionals and Individuals

Advanced Stock Market Forecast

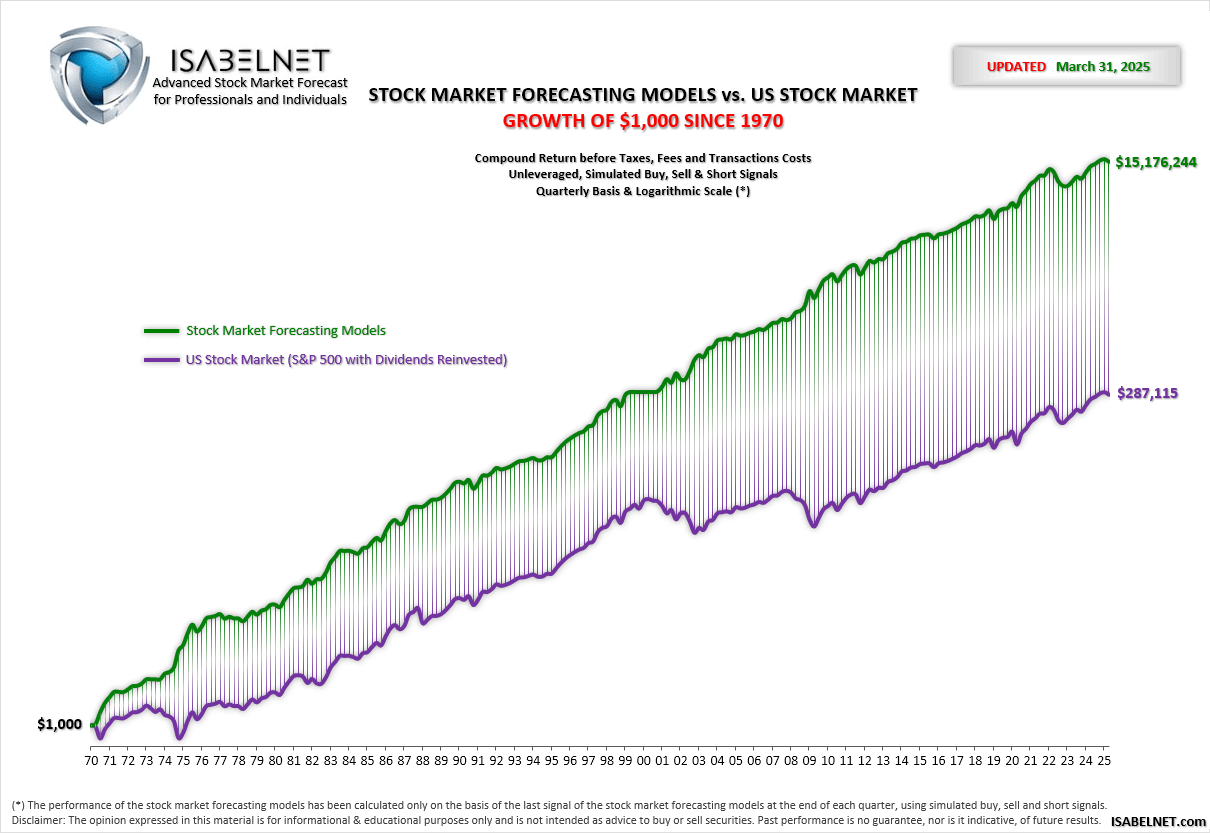

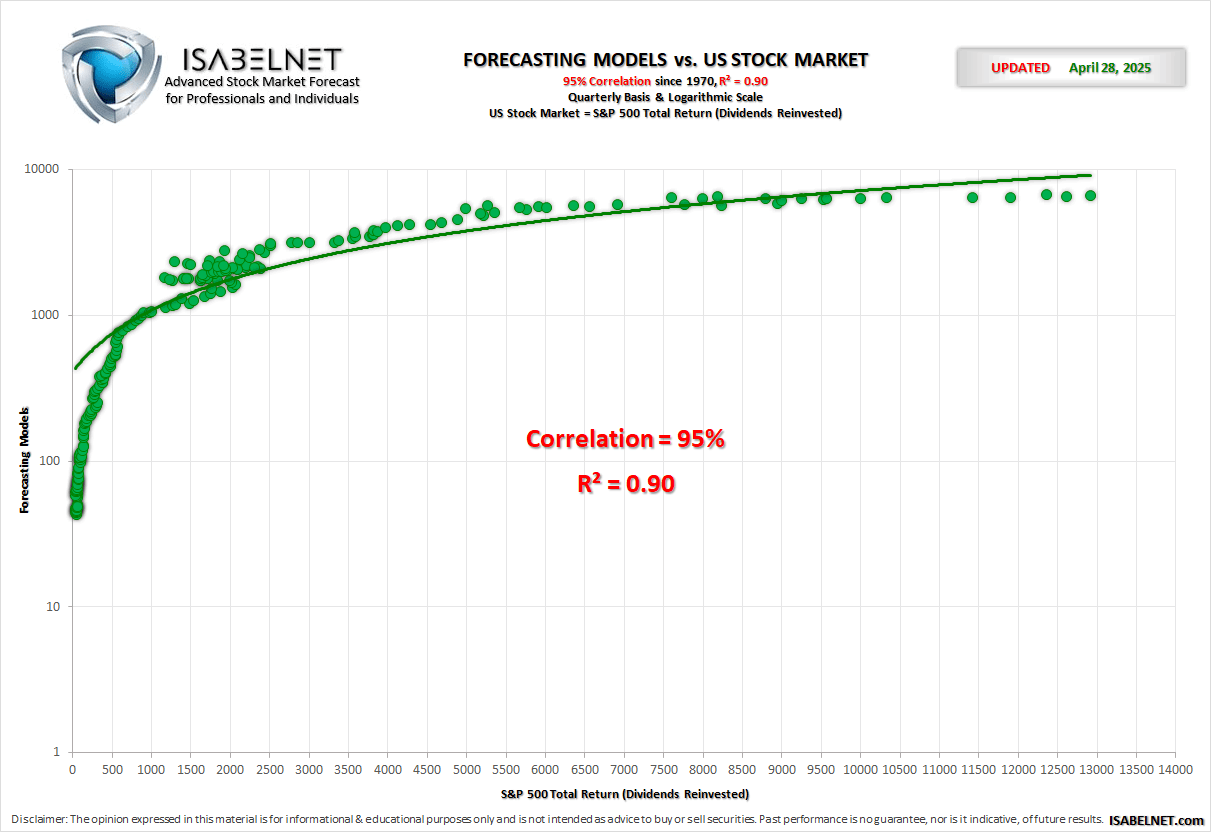

95% Correlation since 1970 Stock Market Valuation Short- and Long-Term Forecasts Bull and Bear Indicator Equity Risk Premium R² = 0.90 since 1970

Our Features

Five Advanced Decision Support Tools

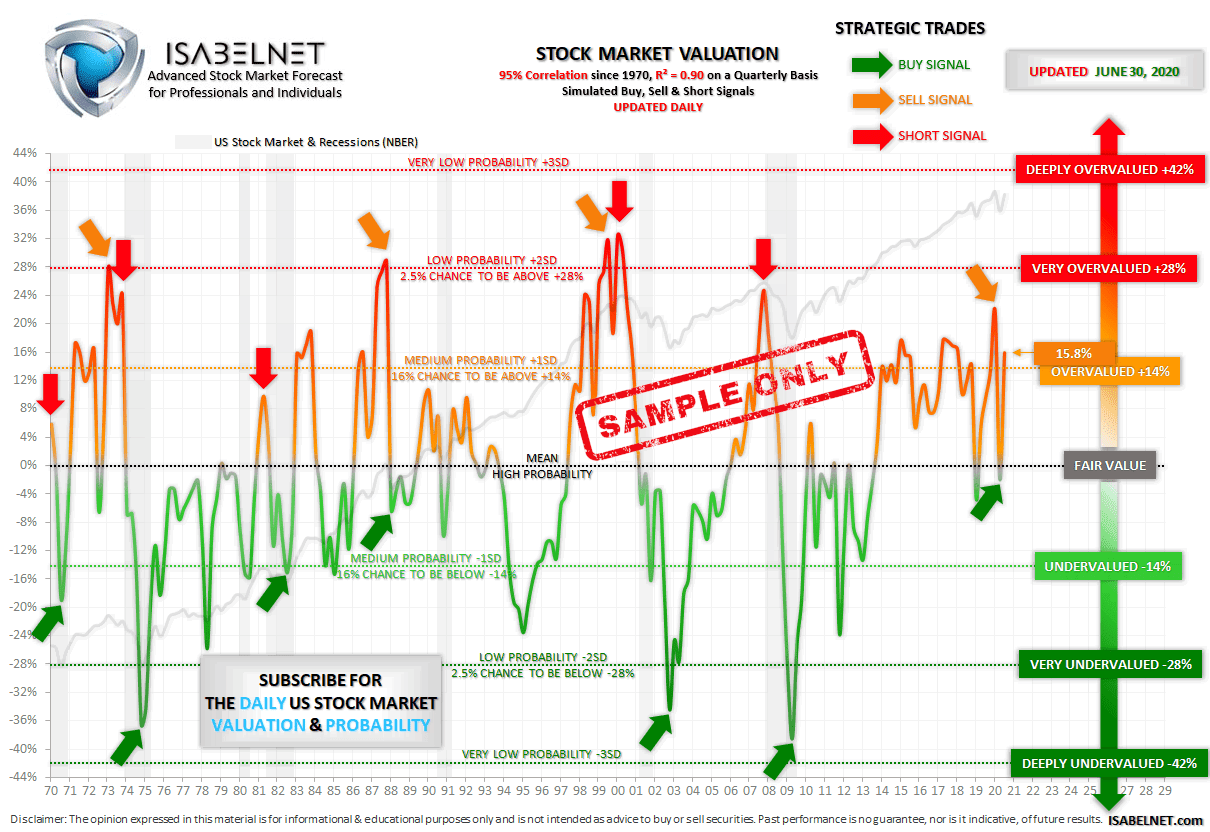

Stock Market Valuation

This powerful model looks into the US stock market and alerts if it is overvalued or undervalued

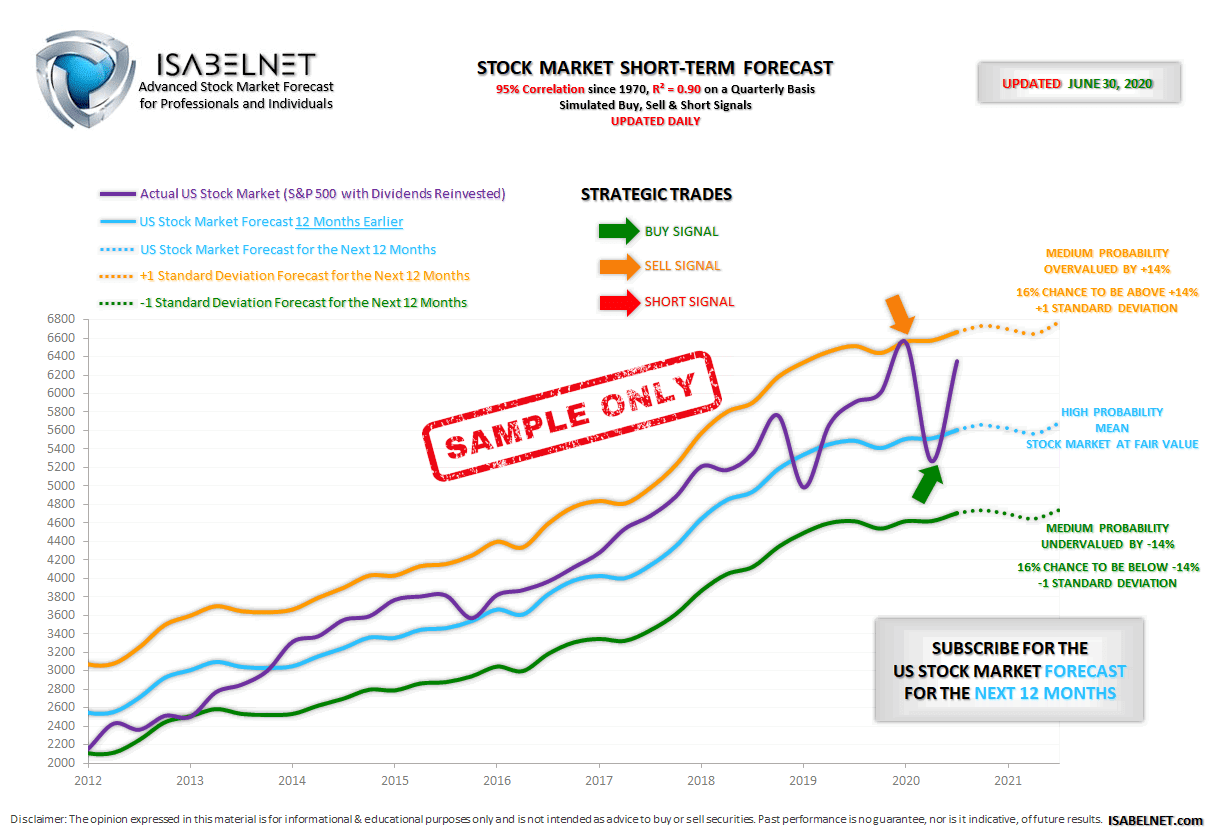

Stock Market Short-Term Forecast

This great tool presents the US stock market forecast for the next 12 months and the probability

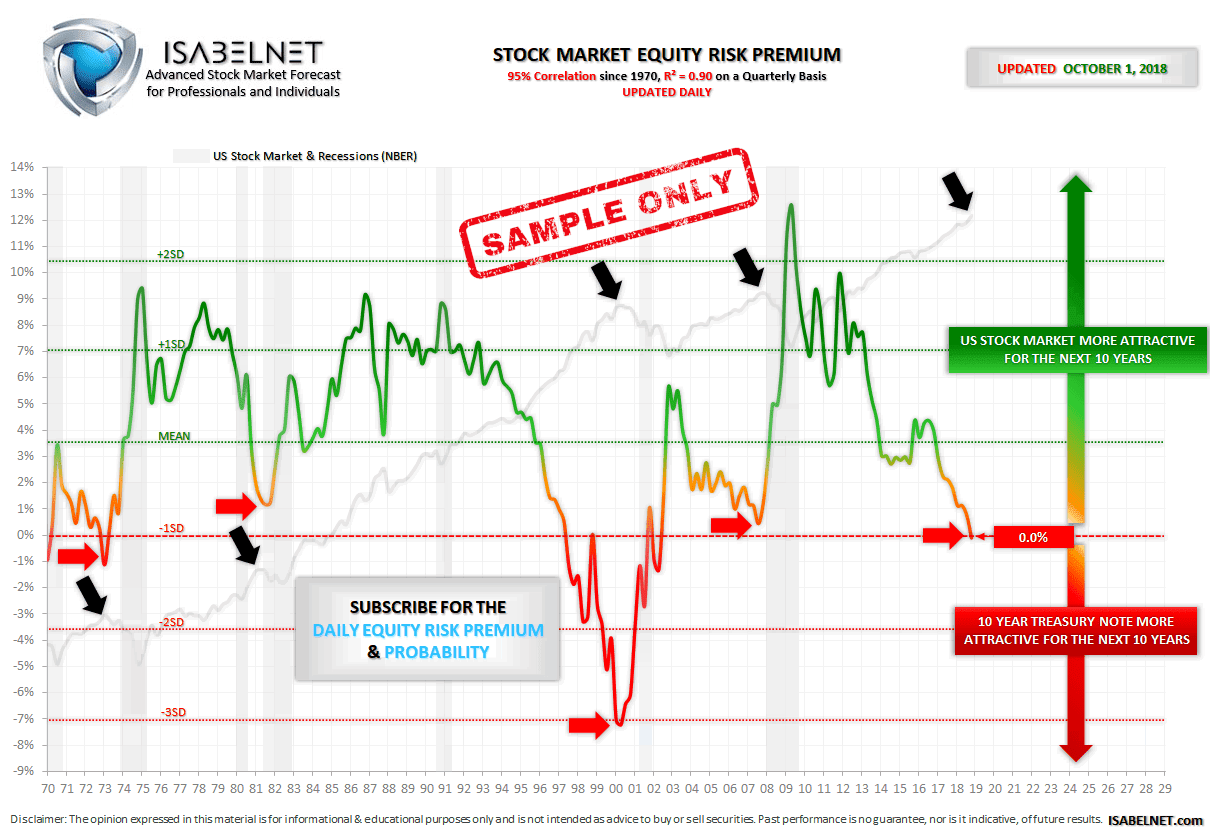

Stock Market Equity Risk Premium

This model shows if the US stock market return is more or less attractive for the next 10 years than the 10-year Treasury note

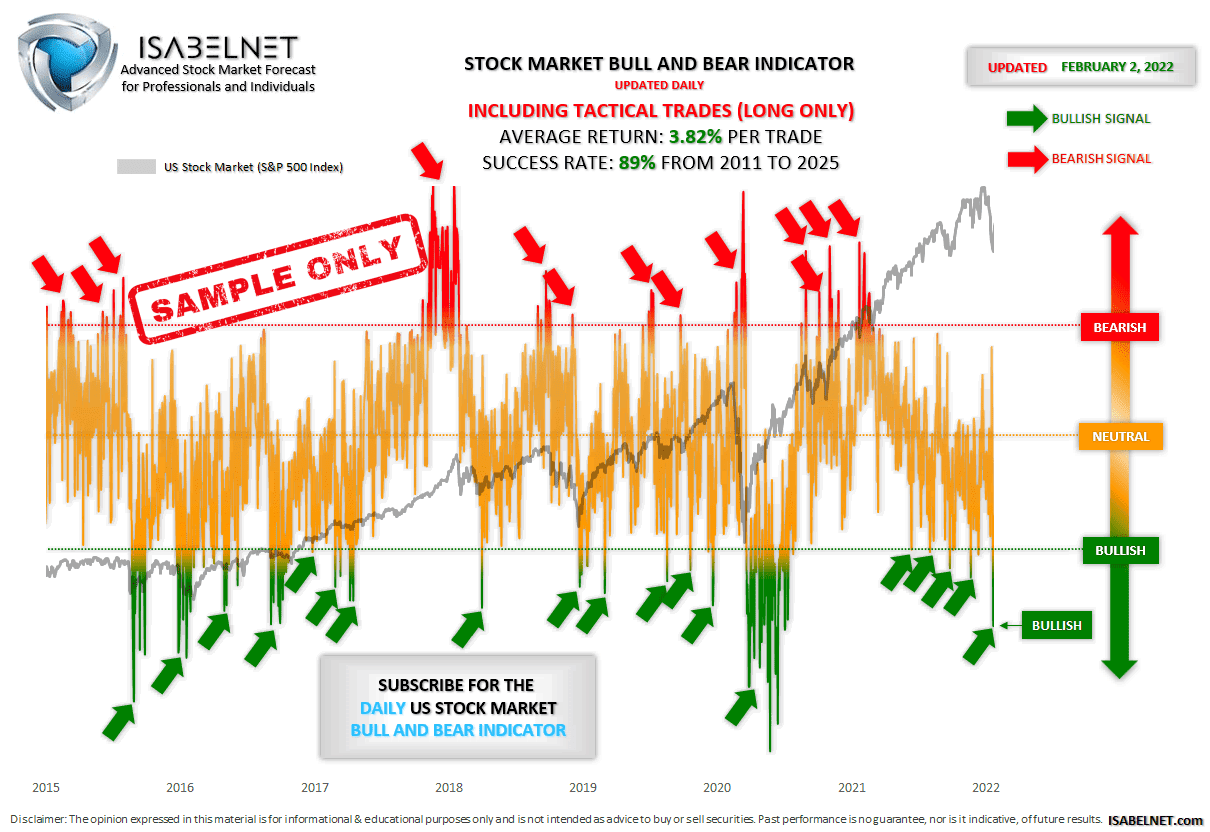

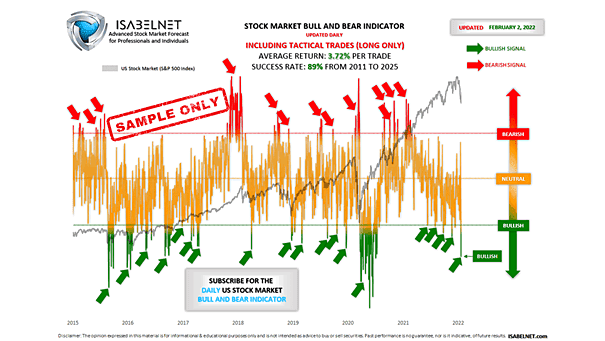

Stock Market Bull and Bear Indicator

This powerful indicator looks into the US stock market and suggests whether it is bullish, bearish or neutral

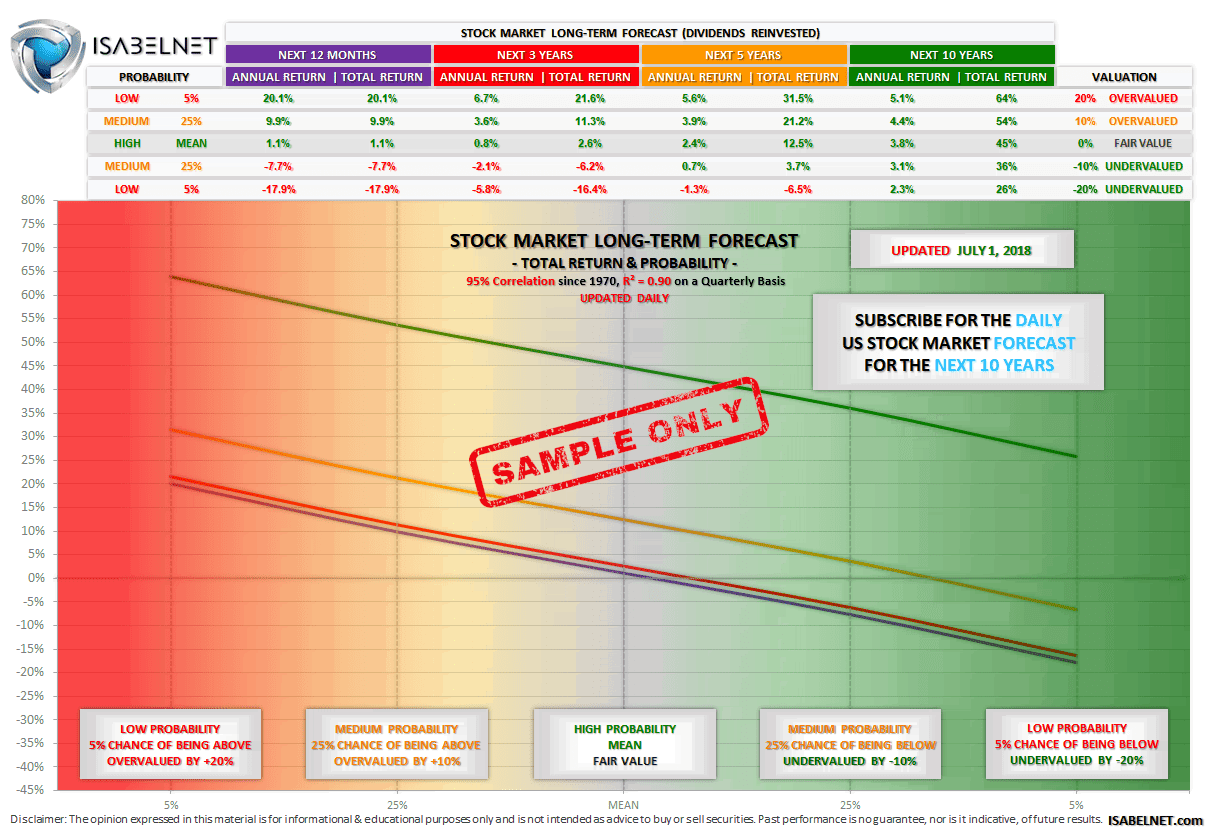

Stock Market Long-Term Forecast

The long-term forecast model displays the annual and total return expected for the next 10 years and the probability

95% Correlation and R² = 0.90 Since 1970

Based on proprietary algorithms, each forecasting model has a 95% correlation with the US stock market since 1970 on a quarterly basis

Recession Indicators

Empower your knowledge and discover a multitude of recession indicators from our daily blog

Advanced Mathematical Models

Thanks to his computer engineering studies and his stock market experience, the founder has developed these great forecasting models

Proprietary Research

30+ Years of Experience

Customer Service & Privacy

We are committed to providing the best service experience possible. Your privacy is important to us. We don’t rent or sell any personal information

Advanced Forecasting Models

Our mathematical models extract insights from multiple financial data and suggest stock market short- and long-term forecasts. Since 1970, our decision support tools have a fantastic 95% correlation with the US stock market (R² = 0.90)

Private Research in Luxembourg

We have more than 30 years of experience using mathematical formulas, algorithms, statistical and market data. Isabelnet headquarters is based in Luxembourg, a financial center of international renown

Start making your

own smart decisions

Market volatility is blamed for causing people to make ill-timed, impulsive investment choice. Therefore, making the right judgment can be challenging.

To see the whole picture instantly, our forecasting models are great decision support tools based on algorithms, and not on emotional responses. They get insights from multiple financial data and help our members to make better and faster choices by extracting the signal from the noise.

Our Pricing Table

Monthly or Annual Subscription

199€/year and save 15%

single user

2 Forecasting Models

Stock Market Valuation

Stock Market Short-Term Forecast

299€/year and save 15%

single user

3 Forecasting Models

Stock Market Valuation

Stock Market Short-Term Forecast

Stock Market Equity Risk Premium

399€/year and save 15%

single user

5 Forecasting Models

Stock Market Valuation

Stock Market Short-Term Forecast

Stock Market Equity Risk Premium

Stock Market Bull and Bear Indicator

Stock Market Long-Term Forecast

Join our Members

Our members are at the heart of our work!

Choose the membership offer that suits your need

The Basic Membership and the Premium Membership can be upgraded to the Pro Membership any time

Latest Posts

U.S. Stock Market Bull and Bear Indicator – S&P 500

U.S. Stock Market Bull and Bear Indicator – S&P 500 Two Fridays ago, our Stock Market Bull & Bear Indicator was bullish well before the opening bell and the S&P 500 followed through, closing up 0.69%. Using multiple financial data, this great model helps investors navigate through different market conditions. It suggests whether the U.S.…

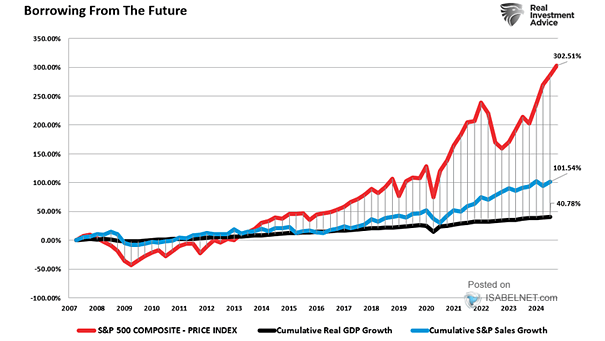

Markets – Cumulative S&P 500 Growth vs. Cumulative Real GDP Growth vs. Cumulative S&P Sales Growth

Markets – Cumulative S&P 500 Growth vs. Cumulative Real GDP Growth vs. Cumulative S&P Sales Growth Years of Fed stimulus have taught investors to buy every dip, pushing U.S. markets skyward and away from the real economy. The disconnect between Wall Street and Main Street has never been clearer. Image: Real Investment Advice

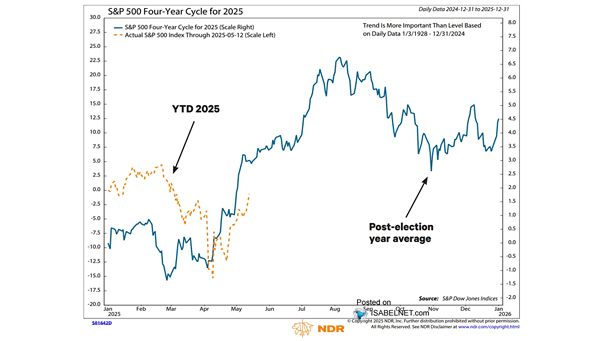

S&P 500 Four-Year Cycle for 2026

S&P 500 Four-Year Cycle for 2026 The recent choppy trade fits the script of the four-year presidential cycle’s midterm-year rhythm. From March to April, the S&P 500 often rallies toward its yearly peak before sentiment softens into the midterms. Image: Ned Davis Research

What Master Investors Say

As Mentionned in...

Among our Advertisers...