Market Capitalization – United States vs. Asia vs. Europe

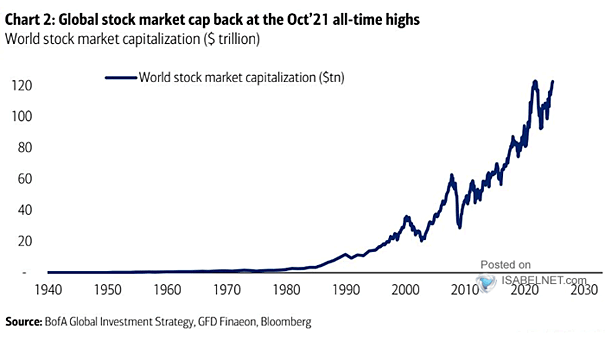

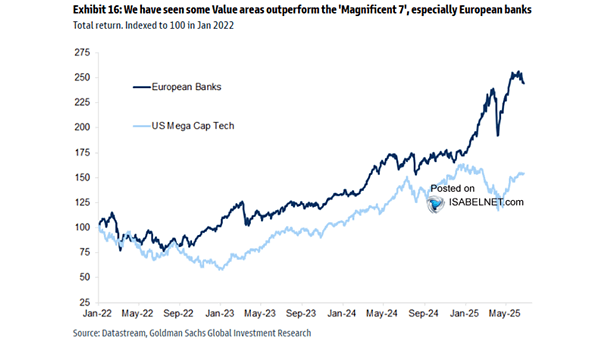

Market Capitalization – United States vs. Asia vs. Europe The U.S. market outperformed global markets over the past decade due to strong earnings, profitability, and capital dynamics, but sustaining this may be challenging given high valuations and other factors. Image: Goldman Sachs Global Investment Research