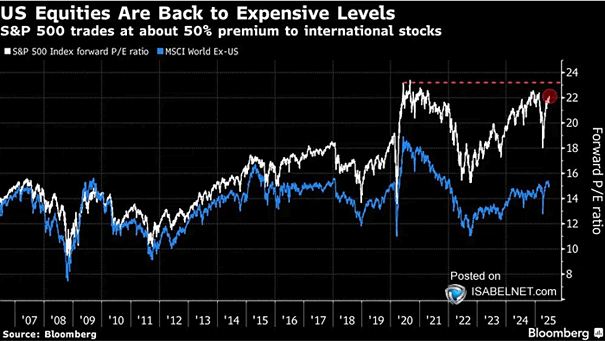

Valuation – S&P 500 Index Forward P/E Ratio vs. MSCI World Ex-U.S. Forward P/E Ratio

Valuation – S&P 500 Index Forward P/E Ratio vs. MSCI World Ex-U.S. Forward P/E Ratio U.S. equities currently trade at roughly a 50% premium over international stocks, fueled by stronger earnings growth, greater profitability, and investors’ willingness to pay extra for these advantages. Image: Bloomberg