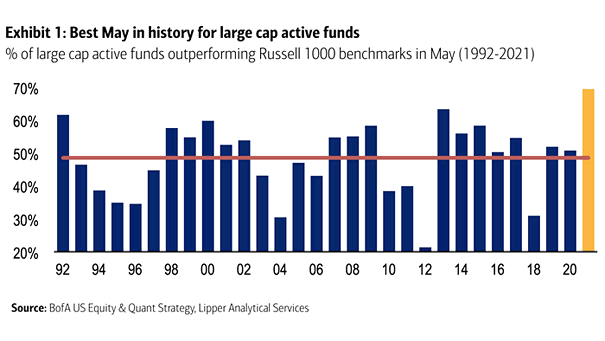

% of Large Cap Active Funds Outperforming Russell 1000 Benchmarks in May

% of Large Cap Active Funds Outperforming Russell 1000 Benchmarks in May Best May in history for actively managed large-cap funds. But can active large-cap funds outperform benchmark over a full market cycle? Image: BofA US Equity & Quant Strategy