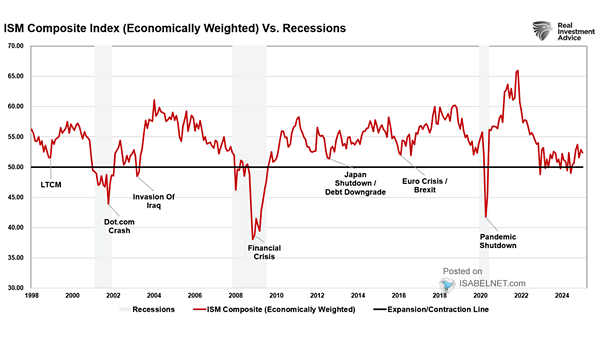

ISM Composite Index vs. Recessions

ISM Composite Index vs. Recessions While indicating slower growth, the economically weighted ISM composite index still points to expansionary conditions in the U.S. economy, without signaling an impending recession. Image: Real Investment Advice