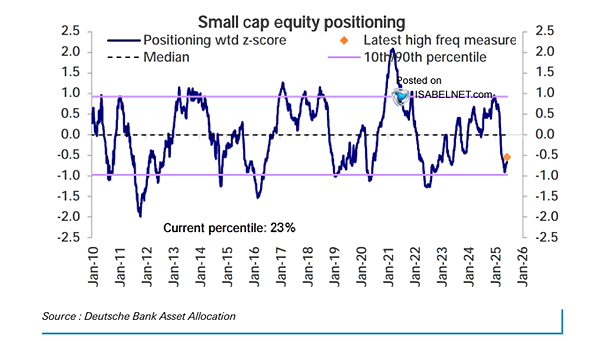

Small Cap Equity Positioning

Small Cap Equity Positioning With small-cap equity allocations at the 23rd percentile, there is considerable room for increased exposure—especially for investors focused on long-term growth. Image: Deutsche Bank Asset Allocation