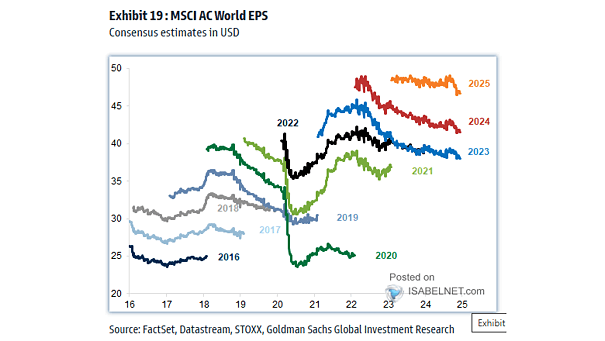

MSCI World EPS

MSCI World EPS The decline in MSCI AC World EPS consensus estimates for 2025 reflects a cautious stance among analysts as they navigate an uncertain economic landscape marked by slower growth and sector-specific challenges. Image: Goldman Sachs Global Investment Research