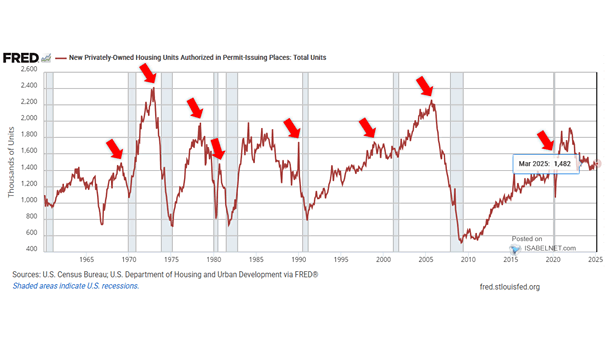

U.S. New Private Housing Units Authorized by Building Permits and Recessions

U.S. New Private Housing Units Authorized by Building Permits and Recessions In May, U.S. building permits declined to 1.393 million, below expectations. Historically, they tend to peak and then decline before economic recessions Image: Federal Reserve Bank of St. Louis