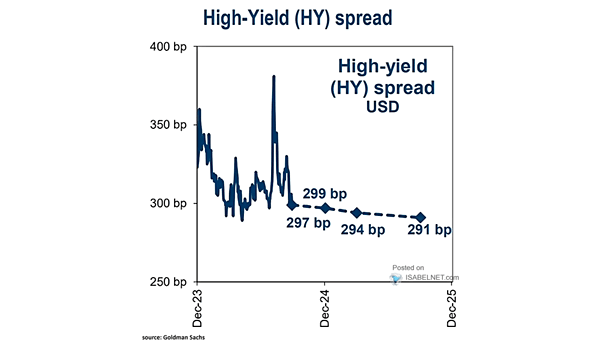

High-Yield (HY) Spread USD

High-Yield (HY) Spread USD Goldman Sachs forecasts a favorable high-yield bond market over the next 12 months, anticipating tighter spreads as a result of robust economic conditions and optimistic investor sentiment. Image: Goldman Sachs Global Investment Research