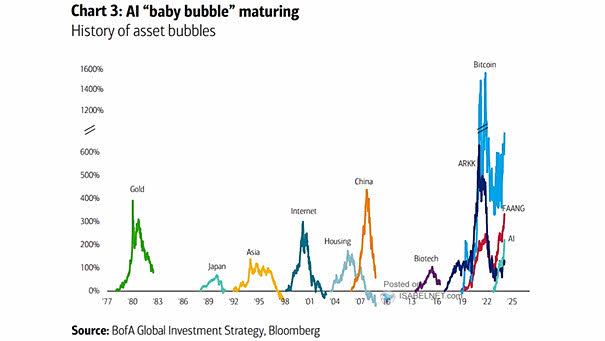

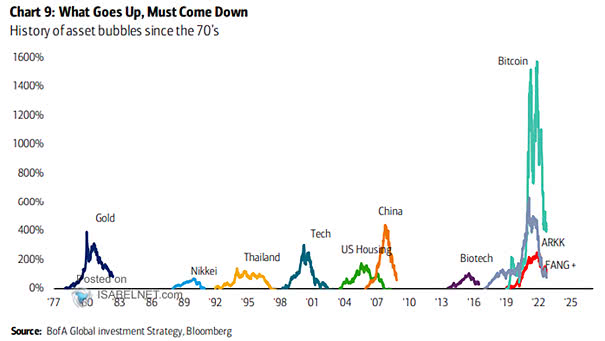

History of Asset Bubbles

History of Asset Bubbles The growing enthusiasm for AI has sparked concerns of a potential valuation bubble, as companies and investors occasionally develop unrealistic expectations about the technology and its capabilities. Image: BofA Global Investment Strategy