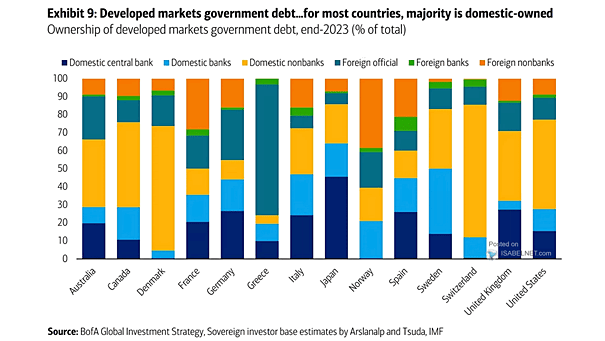

Ownership of Developed Markets Government Debt

Ownership of Developed Markets Government Debt Most U.S. government debt is owned domestically, while foreign investors hold a smaller but still significant portion. Image: BofA Global Investment Strategy