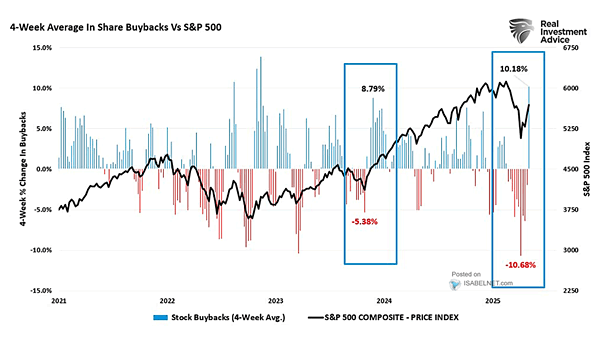

Stock Buybacks vs. S&P 500

Stock Buybacks vs. S&P 500 With companies entering blackout periods in mid-June, share buybacks will slow, reducing a major source of equity demand. In an overbought market, this could amplify any weakness until buybacks return in late July. Image: Real Investment Advice