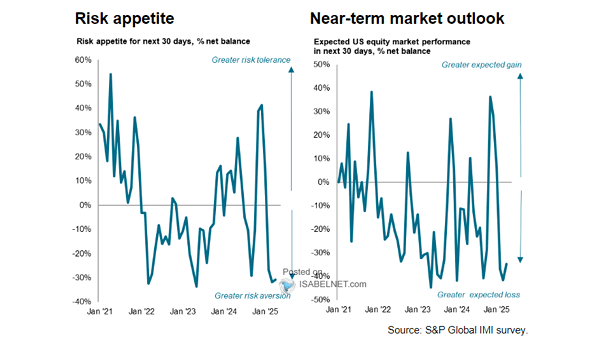

Sentiment – Risk Appetite and Expected U.S. Equity Market Performance

Sentiment – Risk Appetite and Expected U.S. Equity Market Performance For the first time since January 2025, U.S. equity investors’ risk appetite turned positive in July, fueled by stronger confidence in both fundamentals and the macroeconomic landscape. Image: S&P Global Market Intelligence