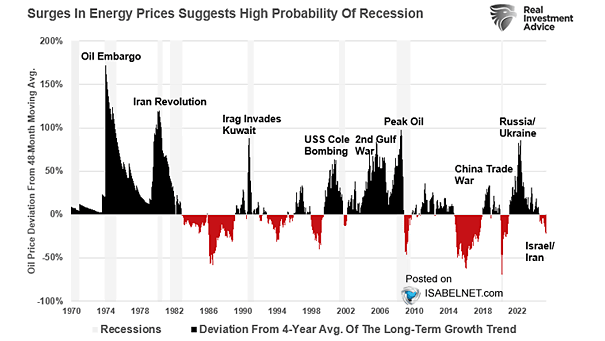

S&P 500 / WTI Spot Price, Detrended

S&P 500 / WTI Spot Price, Detrended The roughly 30-year cycle in the relationship between U.S. stock market returns and oil prices highlights periods when stocks are either expensive or cheap relative to oil. Image: Gavekal, Macrobond