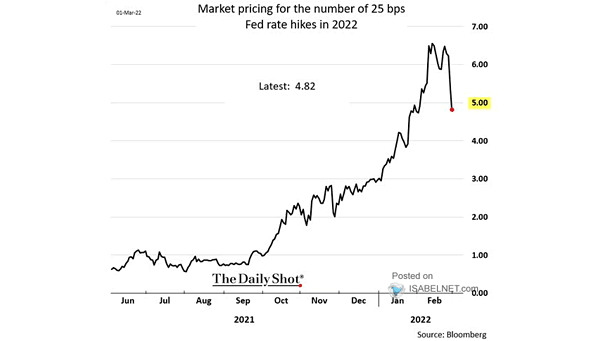

Interest Rates – Market Pricing for the Number of Fed Rate Cuts

Interest Rates – Market Pricing for the Number of Fed Rate Cuts Investors should expect only one 25bps Fed rate cut for the remainder of 2025, most likely in September, unless there is a significant deterioration in economic data or a sharp rise in unemployment. Image: The Daily Shot