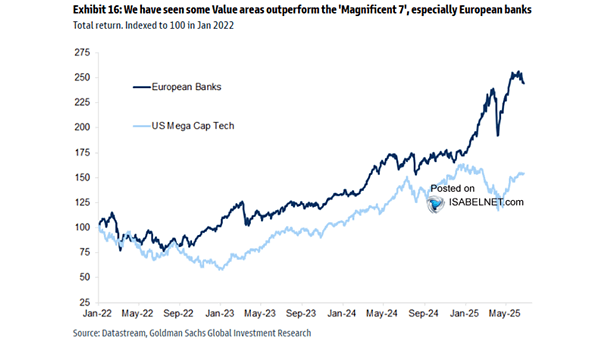

Returns – Magnificent Seven vs. European Banks

Returns – Magnificent Seven vs. European Banks Since January 2022, European banks have outperformed U.S. mega-cap tech stocks—a notable achievement considering the longstanding dominance of American tech giants in global markets. Image: Goldman Sachs Global Investment Research