U.S. 10Y-2Y Yield Curve and Recessions

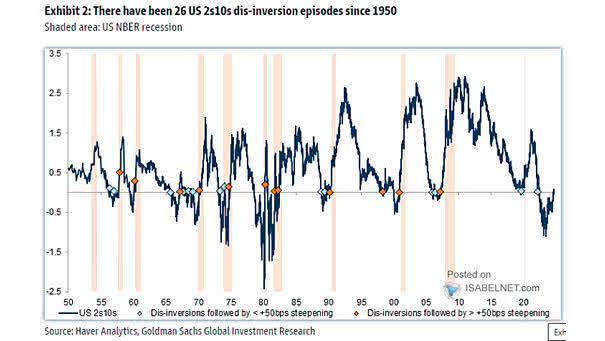

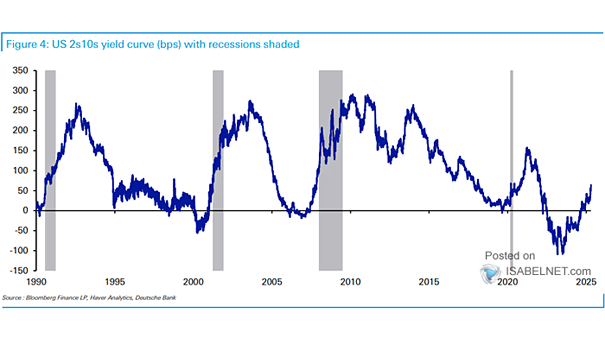

U.S. 10Y-2Y Yield Curve and Recessions Historically, a steepening inverted U.S. 10Y-2Y yield curve has often been an early warning sign of an upcoming recession in the United States. Image: BofA Global Investment Strategy