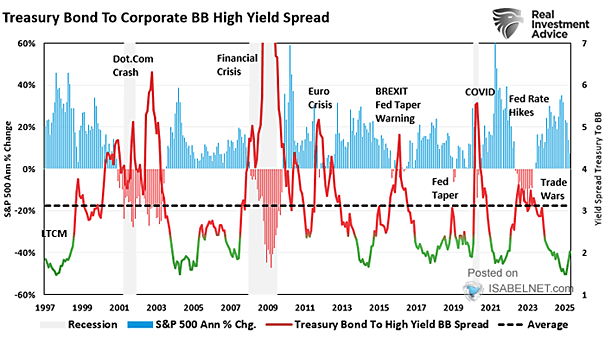

S&P 500 and Treasury Bond to Corporate BB High Yield Spread

S&P 500 and Treasury Bond to Corporate BB High Yield Spread Widening credit spreads often signal upcoming declines in the S&P 500, serving as a valuable leading indicator of equity market stress because they typically react early to shifts in market sentiment and risk. Image: Real Investment Advice