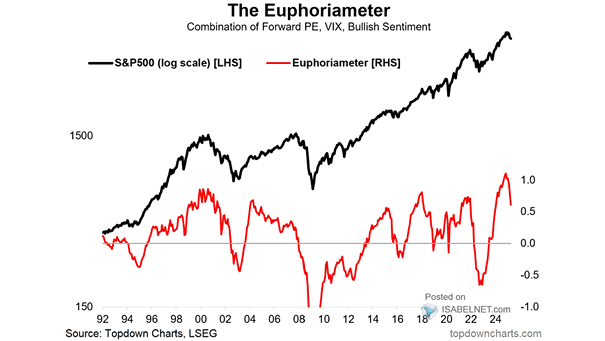

S&P 500 and Combination of Forward PE, VIX, Bullish Sentiment

S&P 500 and Combination of Forward PE, VIX, Bullish Sentiment While the recent reset in H1 may have prolonged the cycle, the Euphoriameter remains at historically cautious levels, suggesting that overly bullish investors still face a risk of future disappointment. Image: Topdown Charts