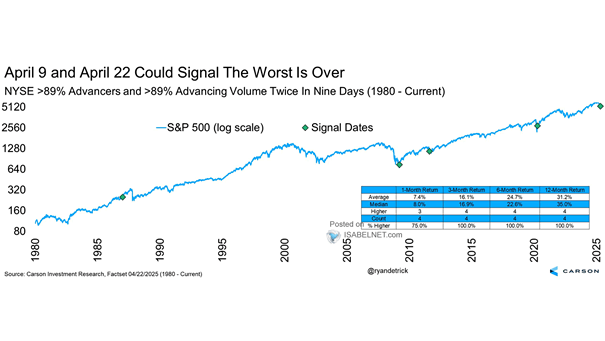

S&P 500 and NYSE >89% Advancers and >89% Advancing Volume in Nine Days

S&P 500 and NYSE >89% Advancers and >89% Advancing Volume in Nine Days A rare event—over 89% of NYSE stocks and volume advancing twice in nine days—has historically signaled strong bullish momentum. Since 1980, the S&P 500 was positive 100% of the time over the next year, with a median 35% gain. Image: Carson Investment…