Different Market Sentiment Indicators

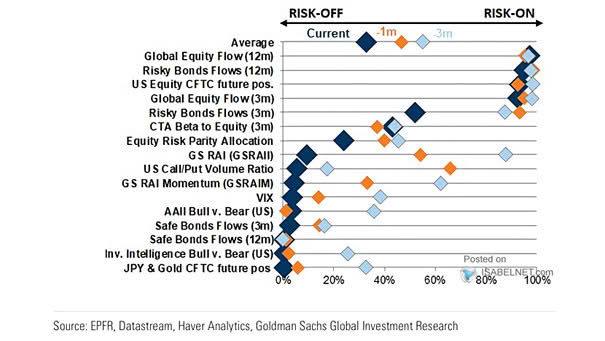

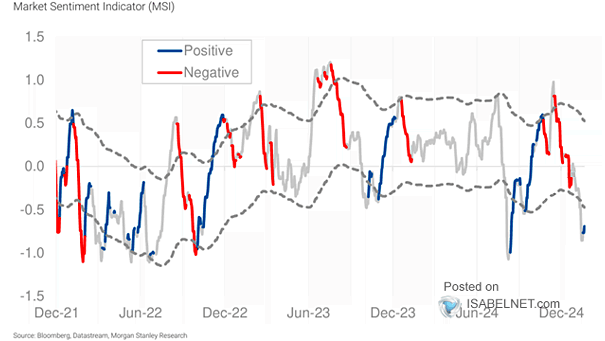

Different Market Sentiment Indicators The prevailing market sentiment is marked by an equilibrium between optimism and caution, with no decisive dominance of bullish or bearish perspectives at present. Image: Goldman Sachs Global Investment Research