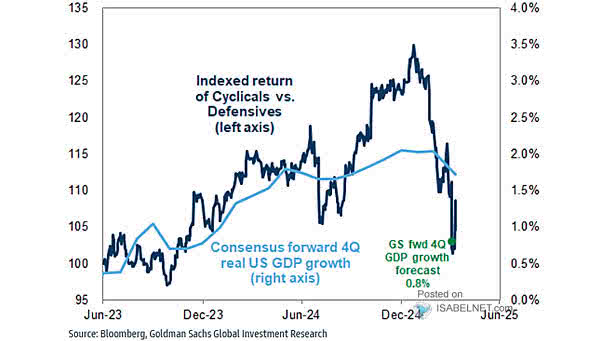

Indexed Return of Cyclicals vs. Defensives and Consensus Forward 4-Quarter U.S. GDP Growth

Indexed Return of Cyclicals vs. Defensives and Consensus Forward 4-Quarter U.S. GDP Growth The combination of strong earnings growth, a more favorable geopolitical environment, and supportive technical indicators has led to a significant upward revision in equity market growth expectations for 2025. Image: Goldman Sachs Global Investment Research