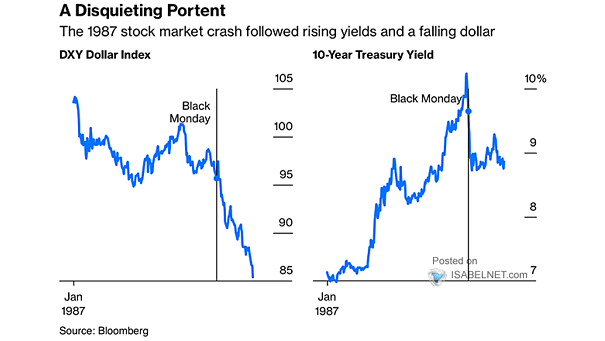

1987 Market Crash – DXY Dollar Index and 10-Year UST Yield

1987 Market Crash – DXY Dollar Index and 10-Year UST Yield Bond yields rarely rise while the dollar falls, as higher yields usually boost currency appeal. This unusual trend signals waning confidence, similar to the pattern seen before the 1987 Black Monday crash. Image: Bloomberg