Apr

27

2019

Off

Was the US Stock Market Crash on October 19, 1987, a "Black Swan" Event?

A “Black Swan” is a metaphor that describes an event that comes as a surprise with a major effect, which is extremely difficult to predict.

The theory was developed by Nassim Nicholas Taleb.

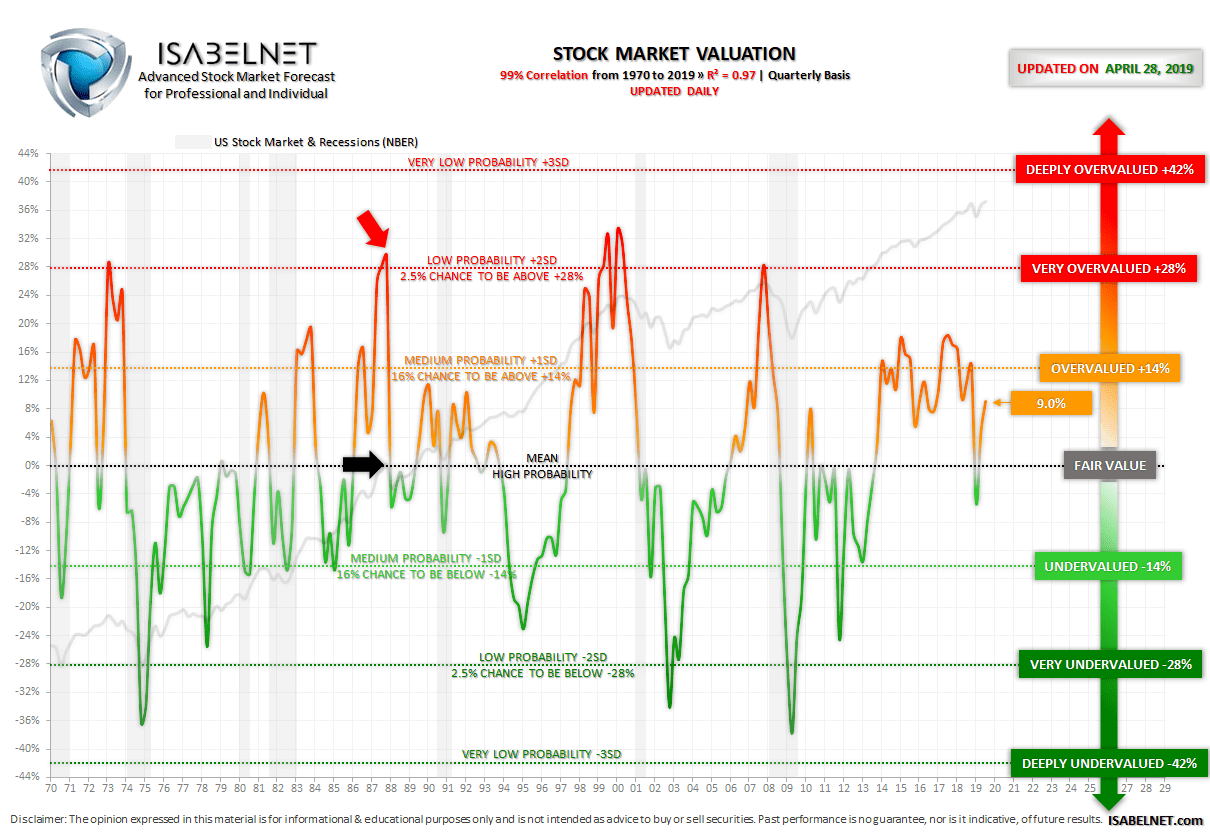

The US stock market on October 19, 1987, also known as Black Monday, fell 22.61%. This advanced valuation model shows that this event was not a “Black Swan” event, because the US stock market was very overvalued by more than +28%. It was a low probability (two standard deviations). Keep in mind that there is a 2.5% chance to be above +28%.

This great valuation model is updated daily. It has a 95% correlation with the US stock market on a quarterly basis since 1970 and an R² of 0.90.