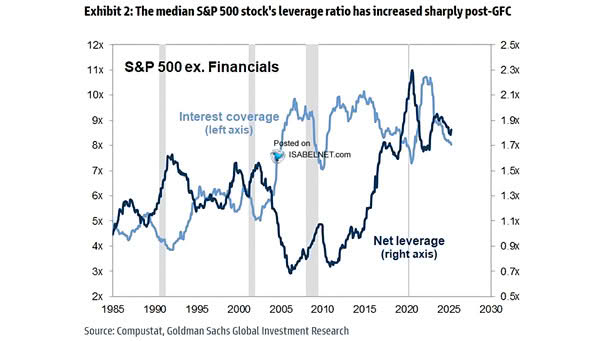

S&P 500 Ex. Financials – Net Leverage and Interest Coverage

S&P 500 Ex. Financials – Net Leverage and Interest Coverage Since the Global Financial Crisis, there has been a sharp increase in the median S&P 500 stock’s leverage ratio, a trend that could have substantial effects on market risk and volatility. Image: Goldman Sachs Global Investment Research