The Conference Board Leading Economic Index (LEI) for the U.S.

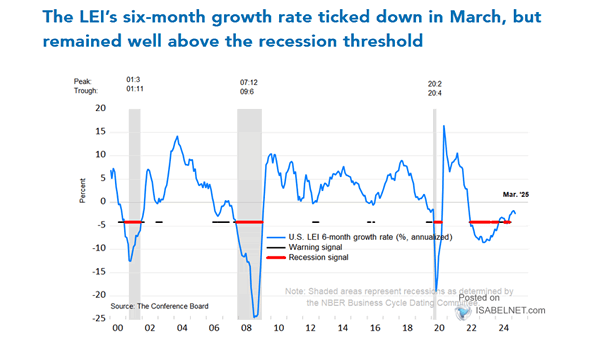

The Conference Board Leading Economic Index (LEI) for the U.S. In May, the U.S. Leading Economic Index (LEI) fell by 0.1%, suggesting that economic growth in 2025 may slow significantly compared to 2024. Image: The Conference Board