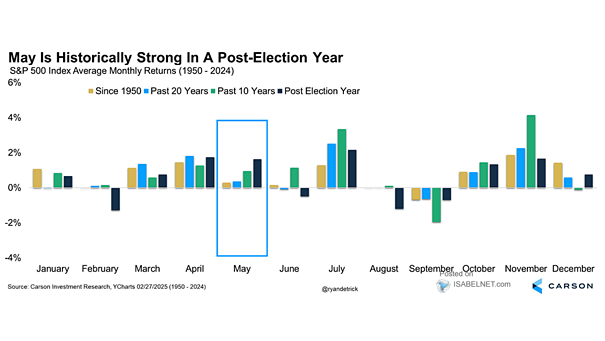

Seasonality – S&P 500 Index Average Monthly Returns

Seasonality – S&P 500 Index Average Monthly Returns Bulls have reason to smile: historically, July has been the best month in post-election years and over the past 20 years. This suggests there is further upside potential ahead. Image: Carson Investment Research