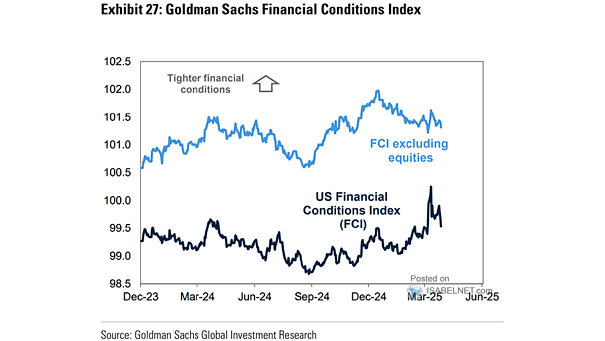

GS U.S. Financial Conditions Index

GS U.S. Financial Conditions Index Easing financial conditions provide a tailwind to U.S. economic growth by supporting consumers and businesses. However, ongoing vigilance regarding inflation risks remains necessary. Image: Goldman Sachs Global Investment Research