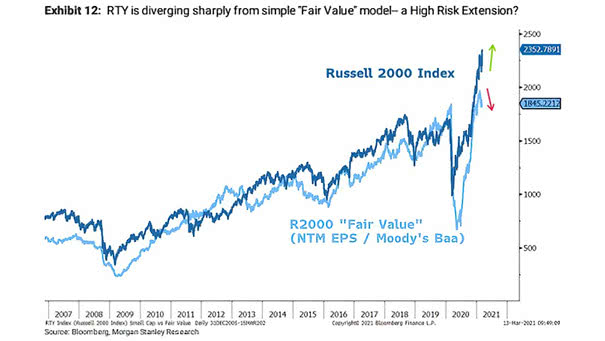

Leon Cooperman: Bull Market Cycles Don’t End at Fair Valuation, They Ended at Overvaluation

Leon Cooperman: Bull Market Cycles Don’t End at Fair Valuation, They Ended at Overvaluation “There is still more room for the market to run. We have a slowdown but not a recession and the market is ok.” Leon Cooperman (Omega Advisors founder) is a great value investor. https://www.youtube.com/watch?v=Xz6ihkuW1AM