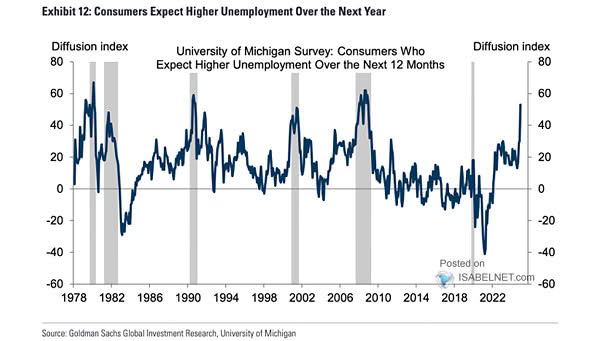

University of Michigan Survey – Consumer Who Expect Higher Unemployment over the Next 12 Months

University of Michigan Survey – Consumer Who Expect Higher Unemployment over the Next 12 Months The latest University of Michigan Surveys of Consumers indicate that a significantly higher share of Americans now expect unemployment to rise over the next year, reaching the highest level since 2009. Image: Goldman Sachs Global Investment Research