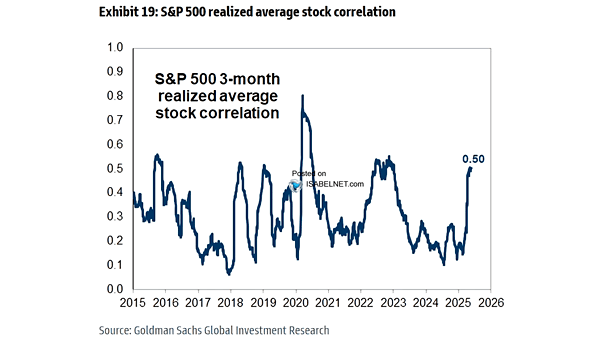

S&P 500 3-Month Realized Average Stock Correlation

S&P 500 3-Month Realized Average Stock Correlation U.S. stock correlations have recently surged to their highest levels since late 2022, indicating that stocks are moving more in tandem than usual—a trend that typically emerges during periods of heightened uncertainty or market stress. Image: Goldman Sachs Global Investment Research