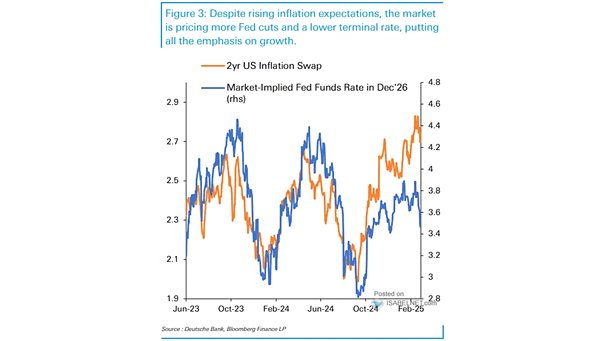

Market-Implied Fed Funds Rate and 2-Year U.S. Inflation Swap

Market-Implied Fed Funds Rate and 2-Year U.S. Inflation Swap Current market pricing of Fed rate cuts indicates a pivot from inflation worries to growth concerns, suggesting investors expect the Fed to prioritize economic stability over aggressive inflation control. Image: Deutsche Bank