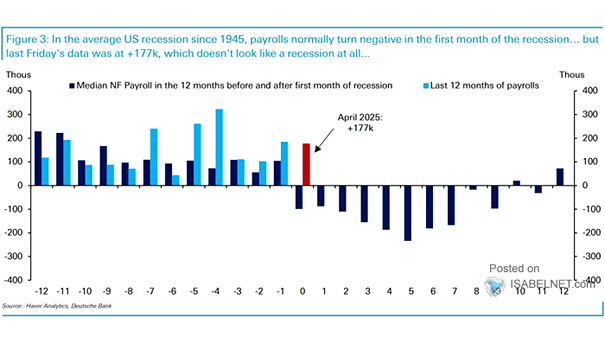

Median Non-Farm Payrolls in the 12 Months Before and After the Start of a U.S. Recession

Median Non-Farm Payrolls in the 12 Months Before and After the Start of a U.S. Recession Consistently adding more than 100,000 payroll jobs each month is considered a vital cushion against recession worries. Continued growth at this pace could bolster confidence in the U.S. economy’s direction over the next few months. Image: Deutsche Bank