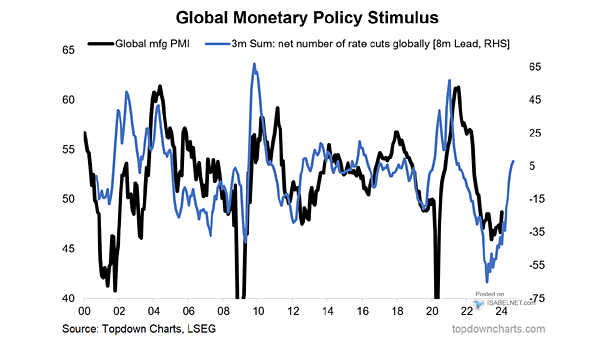

Central Banks – Global Monetary Policy Stimulus Leads Global Manufacturing PMI

Central Banks – Global Monetary Policy Stimulus Leads Global Manufacturing PMI As global monetary policy stimulus tends to lead global manufacturing PMI by 8 months, could this signal the end of the economic slowdown? Image: Topdown Charts