Bear Market Rallies

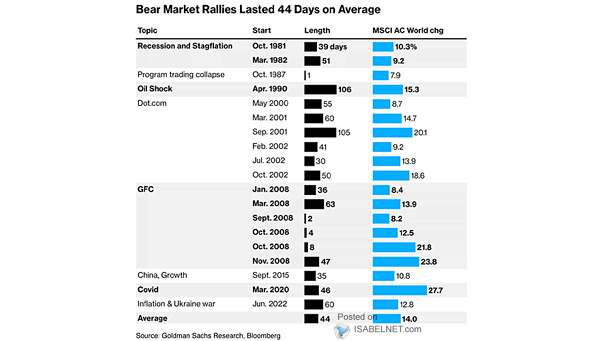

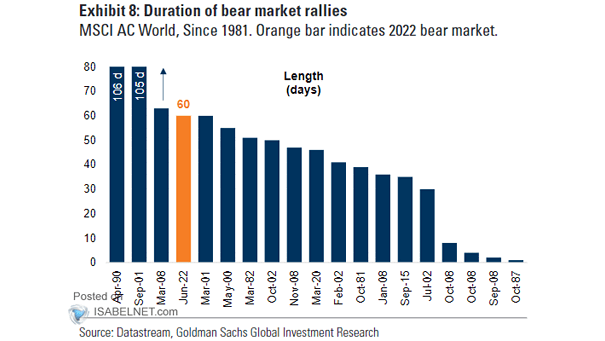

Bear Market Rallies Since 1980, global bear market rallies have averaged 44 days with 14% gains. Prices have already rebounded 18% from the April 7 low. For a sustained recovery, a stronger economic outlook and supportive policies are needed. Image: Bloomberg