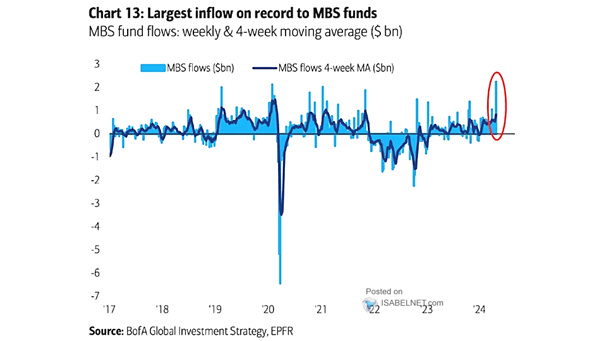

Mortgage-Backed Securities (MBS) Fund Flows

Mortgage-Backed Securities (MBS) Fund Flows Record inflows into mortgage-backed securities over the past week highlight the growing interest in this asset class among investors. Image: BofA Global Investment Strategy