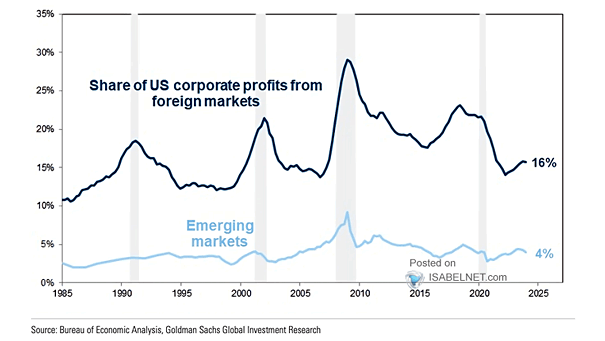

Share of U.S. Corporate Profits from Foreign Markets

Share of U.S. Corporate Profits from Foreign Markets Foreign markets, including emerging markets, significantly contribute to the profits of U.S. corporations. Specifically, they account for 16% of U.S. corporate profits, with emerging markets making up 4% of these profits. Image: Goldman Sachs Global Investment Research