S&P 500 Index and Percent of Members Above 200-Day Moving Average

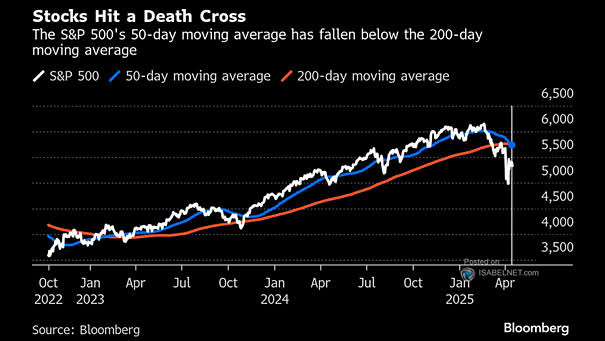

S&P 500 Index and Percent of Members Above 200-Day Moving Average The S&P 500 nears its all-time high, but without improved breadth and broader sector participation, the market risks a correction. Rising indexes amid weak breadth often mark an inflection point, hinting at possible market weakness ahead. Image: Bloomberg