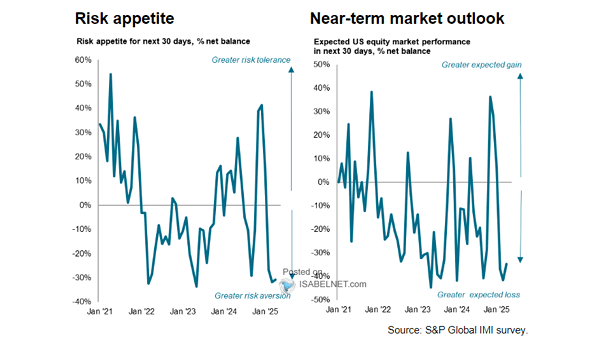

Sentiment – Risk Appetite and Expected U.S. Equity Market Performance

Sentiment – Risk Appetite and Expected U.S. Equity Market Performance U.S. equity investors’ risk appetite has declined in July, marking a shift towards net risk aversion not seen since January. Investors have also grown increasingly pessimistic about the prospects for near-term returns. Image: S&P Global Market Intelligence