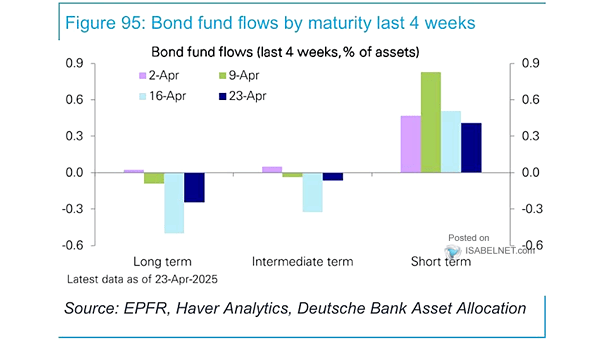

Weekly Bond Fund Flows

Weekly Bond Fund Flows Short-term bond funds continue to attract substantial investor capital due to their combination of safety, liquidity, and relatively stable returns amid market uncertainty. Image: Deutsche Bank Asset Allocation