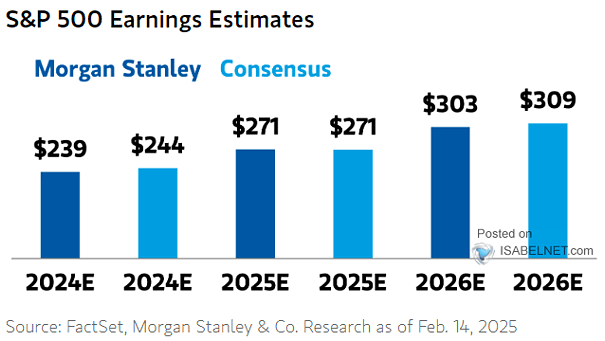

S&P 500 Earnings Estimates

S&P 500 Earnings Estimates Morgan Stanley projects that the S&P 500 will reach earnings per share of $269 in 2025 and $297 in 2026, indicating a positive outlook for profitability and growth. Image: Morgan Stanley Wealth Management