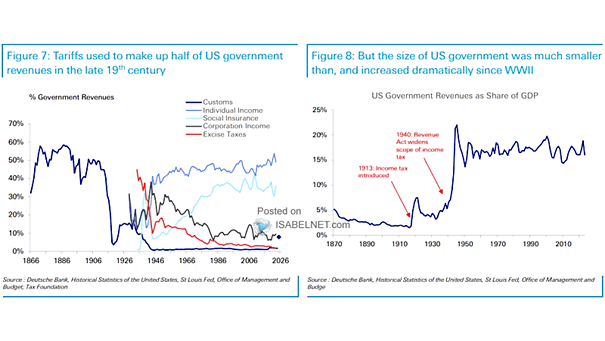

Tariffs and U.S. Government Revenues

Tariffs and U.S. Government Revenues Tariffs played a crucial role in the early industrialization of the United States, but their effectiveness in today’s global economy are potentially detrimental as they act as an economic drag, hurting more industries than they help. Image: Deutsche Bank