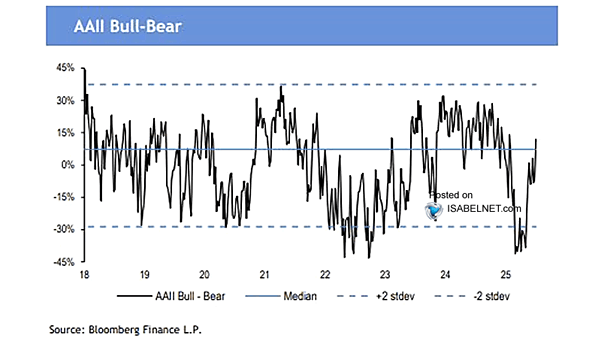

AAII Investor Sentiment Bull Minus Bear Spread

AAII Investor Sentiment Bull Minus Bear Spread The AAII investor sentiment bull-minus-bear spread signals a bullish outlook, reflecting optimism and confidence among individual investors. Image: J.P. Morgan