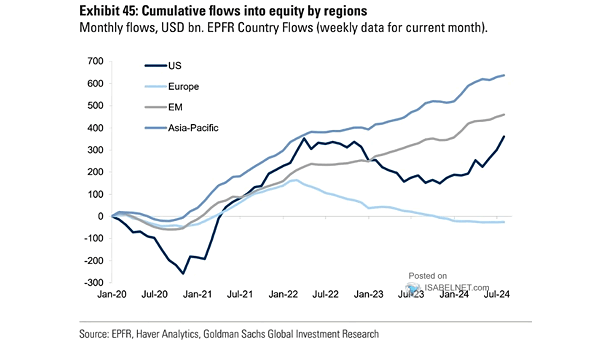

Cumulative Global Equity Fund Flows Across Regions

Cumulative Global Equity Fund Flows Across Regions In 2024, U.S. equities have seen notable inflows, indicating a resurgence of investor confidence despite ongoing concerns about valuations. Image: Goldman Sachs Global Investment Research