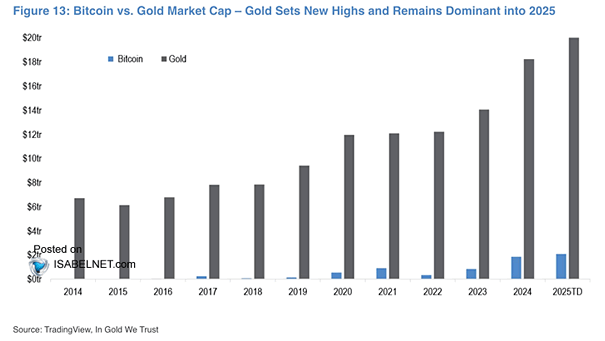

Bitcoin vs. Gold Market Capitalization

Bitcoin vs. Gold Market Capitalization If the trend toward digital financial assets continues and Bitcoin adoption expands, Bitcoin’s upside potential compared to gold is substantial—fueled by its fixed supply, digital utility, and strong growth trajectory. Image: J.P. Morgan